Cash Flow vs. Profitability: Understanding the Difference and Why It Matters

Cash Flow vs. Profitability: Understanding the Difference and Why It Matters

For business owners, terms like "cash flow" and "profitability" are often used interchangeably. However, while they are closely related, they represent two very different aspects of your business’s financial health. Understanding the distinction between the two is critical to making informed decisions, sustaining growth, and avoiding financial pitfalls. Let’s break down what these terms mean, how they differ, and why both matter for the success of your business.

What is Cash Flow?

Cash flow refers to the movement of money in and out of your business. It tracks the actual cash you have available to pay expenses, invest in growth, and handle day-to-day operations. Positive cash flow means more money is coming in than going out, while negative cash flow indicates the opposite.

Key Components of Cash Flow:

- Operating Cash Flow: Money generated from daily business operations, such as sales revenue.

- Investing Cash Flow: Money spent or earned on investments, like purchasing equipment or selling assets.

- Financing Cash Flow:

Cash received from loans or investments and payments made to service debt.

Why Cash Flow Matters:

- It ensures you can pay bills, payroll, and suppliers on time.

- It helps you handle unexpected expenses or downturns.

- It’s critical for maintaining liquidity and avoiding operational disruptions.

What is Profitability?

Profitability measures whether your business is making more money than it’s spending over a specific period. It focuses on your overall financial success, showing if your revenue exceeds expenses.

Key Types of Profit:

- Gross Profit: Revenue minus the cost of goods sold (COGS).

- Operating Profit: Gross profit minus operating expenses.

- Net Profit: The bottom line, calculated as total revenue minus all expenses, including taxes and interest.

Why Profitability Matters:

- It shows whether your business model is sustainable in the long term.

- It’s essential for attracting investors and securing financing.

- It reflects the efficiency of your operations and ability to generate value.

The Key Differences Between Cash Flow and Profitability

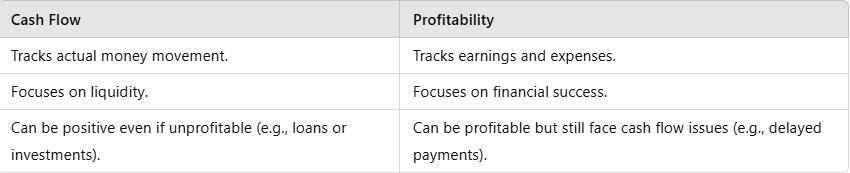

While both cash flow and profitability are essential for a healthy business, they differ in several ways:

Common Pitfalls When Confusing the Two

- Being Profitable but Cash Poor: A business can show a profit on paper but lack the cash to pay bills due to slow collections or high inventory costs.

- Positive Cash Flow Without Real Profit: A business might have strong cash flow due to loans or asset sales but may still be unprofitable, which isn’t sustainable long-term.

How to Balance Both for a Healthy Business

- Monitor Regularly: Use tools like cash flow statements and profit-and-loss statements to keep tabs on both metrics.

- Improve Accounts Receivable: Encourage faster payments from customers with clear terms or early payment discounts.

- Control Expenses: Review your expenses regularly to identify areas for cost savings.

- Build a Cash Reserve: Maintain an emergency fund to cover short-term cash flow gaps.

- Leverage Financing Smartly: Use lines of credit or working capital loans to support cash flow without compromising profitability.

Final Thoughts

Cash flow and profitability are both critical to the success of your business, but they serve different purposes. Profitability measures your financial success, while cash flow ensures you can keep operations running smoothly. By understanding and managing both effectively, you’ll set your business up for sustained growth and resilience in the face of challenges.